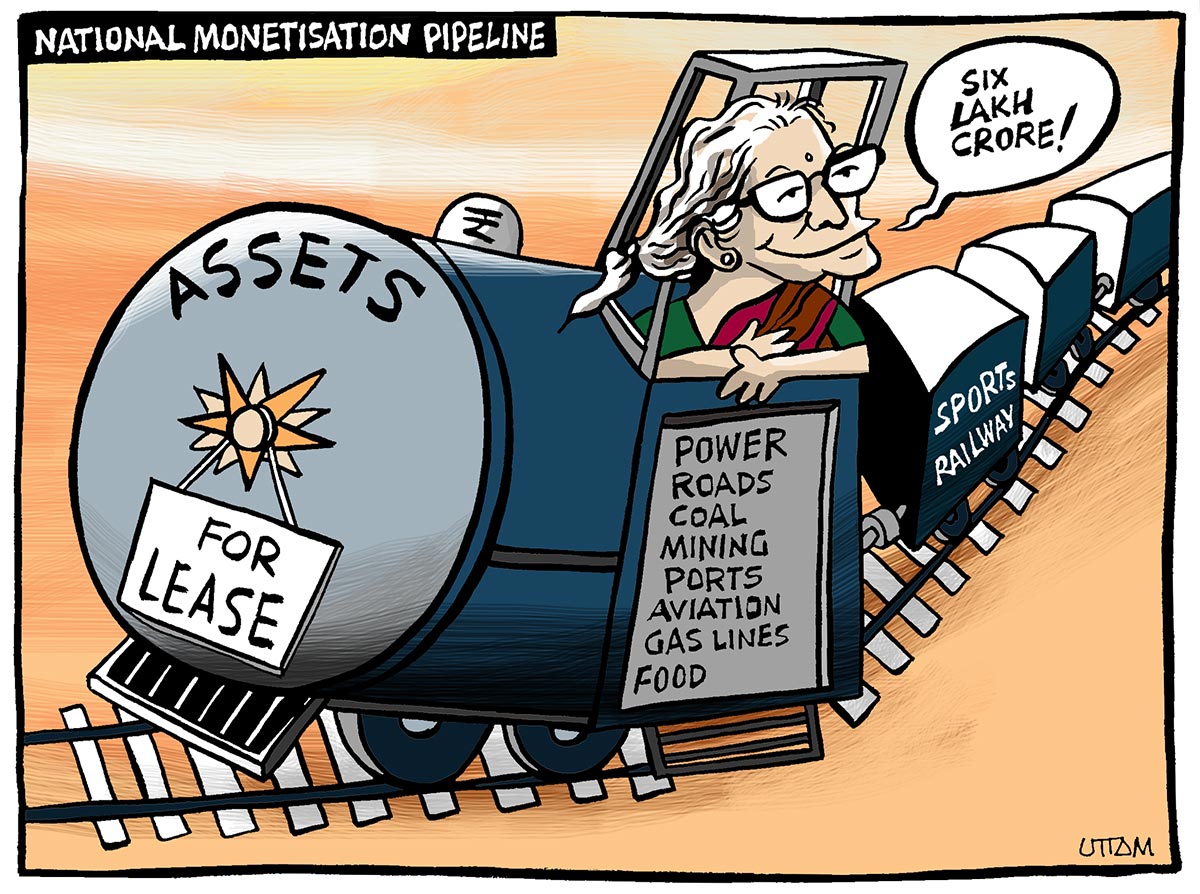

Here we will try to cover the aspects of the National Asset Monetisation Pipeline with various terms such as (InvITs, FSDC, Brownfield Infrastructure), etc.

WHAT IS THE NATIONAL ASSET MONETIZATION PIPELINE?

Recently the Finance Minister has launched the National Asset Monetisation Pipeline for the brownfield infrastructure assets aimed to list the public assets on lease and it involves the creation of new sources of revenue by unlocking the value of unutilized and underutilized public assets to private investors over the next four years.

The National Asset Monetisation Pipeline aims to unlock the value of only brownfield assets (the term brownfield is used for purchasing or leasing existing production facilities to launch a new production activity).

Here the government will not transfer any ownership rights to the private sector. After a certain period, the private sector will have to return the assets which have been taken on lease to the government unless the lease is extended.

WHY THE NATIONAL ASSET MONETISATION PIPELINE PLAN?

The government is expected to fetch around Rs. 5.96 lakh crore through these assets Roads, Stadiums, Railways, Ports, Power Transmission, Urban Real Estate, Telecom, Aviation, Warehousing, Mining, and Natural Gas Pipeline, etc by the year 2022 to 2025 which could help to fund National Infrastructure Pipeline worth Rs.100 crore.

In December 2019 the government has announced the National Infrastructure Pipeline with an estimated cost of Rs 100 lakh crore.

To meet the estimated cost of Rs 100 lakh crore the government has announced the National Asser Monetization Pipeline as the government was unable to mobilize Rs.100 lakh crore. The National Infrastructure Pipeline will create employment opportunities, provides equitable access to infrastructure for all and it will also improve ease of living for all.

HOW THE NATIONAL ASSET MONETIZATION PLAN WILL HELP THE ECONOMY?

It will help the economy in various ways. Let’s have a look at those ways.

- The Government can use the money, acquired through leasing out Assets, to build fresh infrastructure under the National Infrastructure Pipeline (NIP).

- Analysts believe that the National Asset Monetisation Pipeline will boost economic activity along with providing employment opportunities to unemployed people.

- Finance Minister has said that leasing out assets is expected to modernize assets that are earlier languishing.

- The National Asset Monetisation Plan (Resource Efficiency) will lead to optimum utilization of government assets.

- The National Asset Monetisation Plan will promote PPP (Public-Private Partnership).

WHAT ARE THE RISKS ASSOCIATED WITH THE NATIONAL ASSET MONETISATION PIPELINE?

Some risks are also associated with this plan apart from having advantages. Let’s quickly have a look on the other side.

- By leasing out assets like airports, railways and roads could lead to higher prices for consumers.

- Low interest among investors in national highways below four lanes.

- Regulated tariffs on power sector assets.

- Lack of Dispute Resolution mechanisms.

- Lack of Independence Sectoral Regulators.

The last year 2019 the Cabinet authorized the National Highway Authority of India to set up InvITs to monetize highway projects. First, let’s try to understand the term (InvITs), it is an Infrastructure Investment Trusts similar to mutual funds, which collects investment from various investors and invest them into infrastructure projects, creating returns for the investor.

FSDC (Financial Stability and Development Council) was first put forward by the Raghuram Rajan Committee in 2008. It was constituted under the Ministry of Finance. FSDC is a non-statutory apex council, came into existence by the executive order in 2010. FSDC aims to facilitate and deal with the issues such as financial sector development, financial stability, and inter-regulatory coordination.

Finance Minister will soon chair a meeting of the Financial Stability and Development Council (FSDC) to nudge financial regulators (RBI (Reserve Bank of India), SEBI (Securities and Exchange Board of India), IRDA (the Insurance Regulatory and Development Authority), and PFRDA (the Pension Fund Regulatory and Development Authority), to relax and harmonize investment norms for instruments like Infrastructure Investment Trusts (InvITs) to be used to monetize public assets like highways, railway tracks, and had pipelines.

WAY FORWARD

Recently, the Foreign Direct Investment (FDI) of Rs.15,000 crore proposal in Anchorage Infrastructure Investment Holding (AIIH) Limited has been cleared by the Cabinet Committee on Economic Affairs (CCEA) which will boost the National Asset Monetisation Pipeline.

Ensuring the Execution of the National Monetisation Plan effectively with a robust Dispute Redressal Mechanism is a key to its success.

The government has emphasized National Asset Monetisation Pipeline in the Union Budget in 2021-2022 to raise infrastructure.

Amitabh Kant CEO of Niti Aayog has said that asset monetization is the way the country will move forward and the Asset Monetisation Pipeline will help to build world class-Infrastructure. We all hope that the execution of world-class infrastructure will boost the economy in the long run.